Introduction

Your credit score is more than just a number—it’s a key that can unlock numerous financial opportunities or become a barrier to achieving your goals. From securing favorable mortgage rates to qualifying for premium credit cards, your creditworthiness influences many aspects of your financial life. When facing credit challenges, many Americans consider credit repair as a potential solution. But what exactly does credit repair entail, and is it the right choice for your situation?

Understanding Credit Repair

Credit repair is the systematic process of improving your credit score by addressing negative items, known as derogatory marks, on your credit report. These marks can include various issues, from simple reporting errors to more serious problems like:

- Late payments

- Collections accounts

- Bankruptcies

- Foreclosures

- Tax liens

- Identity theft-related problems

According to a recent Consumer Reports study, 44 percent of Americans who reviewed their credit reports discovered at least one error. This statistic highlights the importance of regular credit monitoring and the potential value of credit repair services.

The Advantages of Credit Repair Services

1. Professional Expertise and Time Savings

One of the primary benefits of working with a credit repair company is gaining access to professional expertise. Credit repair specialists understand the complexities of credit reporting laws, including:

- The Fair Credit Reporting Act (FCRA)

- The Fair Debt Collection Practices Act (FDCPA)

- The Credit Repair Organizations Act (CROA)

2. Faster Resolution of Credit Issues

Credit repair companies can often expedite the process of addressing credit problems. Their experience with:

- Identifying reporting errors

- Filing disputes

- Following up with credit bureaus

- Negotiating with creditors

can lead to quicker resolution compared to handling these tasks independently.

3. Comprehensive Credit Analysis

Professional credit repair services provide thorough analysis of your credit reports from all three major credit bureaus:

This comprehensive review can uncover issues you might miss on your own, including:

- Duplicate accounts

- Mistaken identities

- Outdated information

- Fraudulent accounts

4. Potential for Significant Score Improvement

When successful, credit repair can lead to meaningful improvements in your credit score. This can result in:

- Lower interest rates on loans

- Better credit card offers

- Improved insurance premiums

- Enhanced rental application approval odds

The Disadvantages of Credit Repair Services

1. Cost Considerations

One of the most significant drawbacks of professional credit repair services is the cost. Typical fees include:

- Initial setup fees: $19-$200

- Monthly service charges: $50-$150

- Additional services costs:

- Credit monitoring

- Identity theft protection

- Dark web monitoring

2. No Guaranteed Results

As Andrew Smith, director of the Federal Trade Commission’s Bureau of Consumer Protection, warns, “Credit repair companies cannot remove accurate negative information from your credit report.” Success depends on various factors:

- The nature of the credit issues

- The accuracy of the information

- Creditor cooperation

- Your ongoing financial behavior

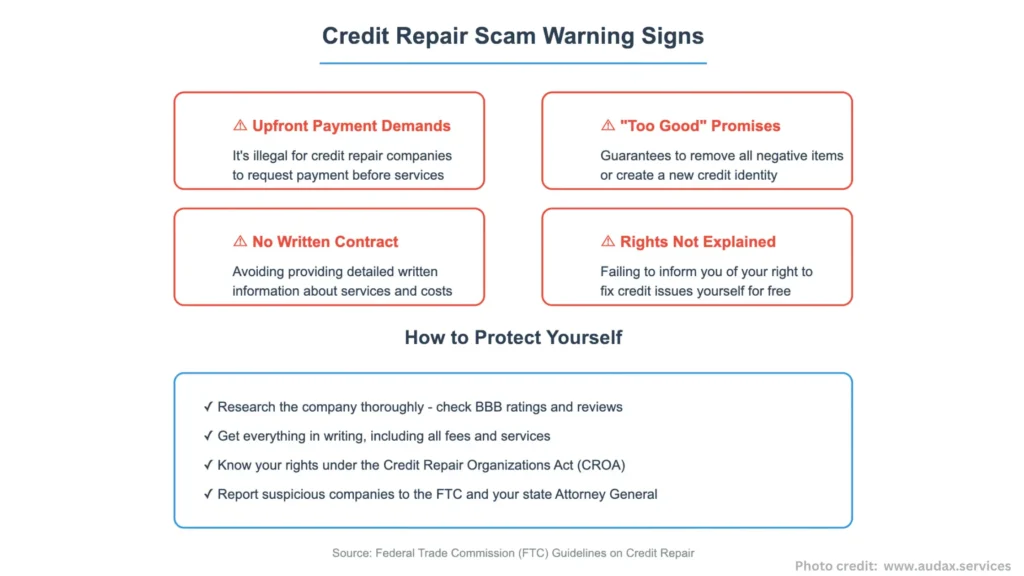

3. Risk of Scams

The credit repair industry has its share of unethical operators. Red flags to watch for include:

- Demands for upfront payment

- Promises to remove accurate negative information

- Failure to explain your legal rights

- Pressure to avoid contacting credit bureaus directly

Alternative Approaches to Credit Repair

DIY Credit Repair

You can take several steps to improve your credit on your own:

- Request free credit reports from AnnualCreditReport.com

- Review reports for errors

- File disputes directly with credit bureaus

- Contact creditors to negotiate payments or settlements

Credit Counseling Services

Nonprofit credit counseling agencies offer various services:

- Financial education

- Budgeting assistance

- Debt management plans

- Personalized credit improvement strategies

Structured Debt Repayment Strategies

Two popular approaches to debt reduction:

Debt Snowball Method

- Focus on smallest debts first

- Build momentum through quick wins

- Maintain minimum payments on other debts

Debt Avalanche Method

- Target highest-interest debts first

- Save money on interest charges

- Require more patience for visible results

Making an Informed Decision

Consider these factors when evaluating credit repair options:

Current Credit Situation

- Number and type of negative items

- Age of derogatory marks

- Overall credit score

Financial Resources

- Available budget for services

- Time commitment for DIY approach

- Emergency savings status

Timeline

- Urgent credit needs

- Long-term financial goals

- Patience for results

Conclusion

Credit repair can be a valuable tool for improving your financial health, but it’s essential to approach it with realistic expectations and a clear understanding of the pros and cons. Whether you choose to work with a professional service or tackle credit improvement independently, success ultimately depends on:

- Consistent effort

- Patience

- Responsible financial habits

- Regular credit monitoring

Before making a decision, carefully evaluate your options and choose the approach that best aligns with your financial goals and resources.

Take the first step toward better credit today. Start by requesting your free credit reports from AnnualCreditReport.com and reviewing them for accuracy. Consider consulting with a nonprofit credit counseling agency to discuss your options and develop a personalized plan for credit improvement.

Frequently Asked Questions

How long does credit repair typically take?

The timeline varies depending on:

- The complexity of credit issues

- Number of items being disputed

- Response time from credit bureaus

- Your ongoing credit management

Most people see initial results within 3-6 months, but significant improvements may take longer.

Can credit repair remove all negative items from my credit report?

No. Legitimate, accurate negative information must remain on your credit report for up to 7-10 years, depending on the type of item.

Is credit repair worth the cost?

The value depends on your situation. Consider:

- Severity of credit issues

- Potential savings on future interest rates

- Your ability to handle disputes independently

- Available time and resources

How much does credit repair usually cost?

Expect to pay:

- Setup fees: $19-$200

- Monthly fees: $50-$150

- Additional services: Varies by provider and package

Can I repair my credit on my own?

Yes. The Fair Credit Reporting Act gives you the right to dispute inaccurate information directly with credit bureaus at no cost.

In another related article, Best Credit Repair Services In Chicago