State Employees Credit Union (SECU) stands as North Carolina’s largest mortgage lender by loan volume as of 2023, offering competitive mortgage rates and flexible lending solutions across five southeastern states. This comprehensive guide examines SECU’s current mortgage rates, loan programs, and unique benefits for prospective homebuyers.

Current SECU Mortgage Rates (2024)

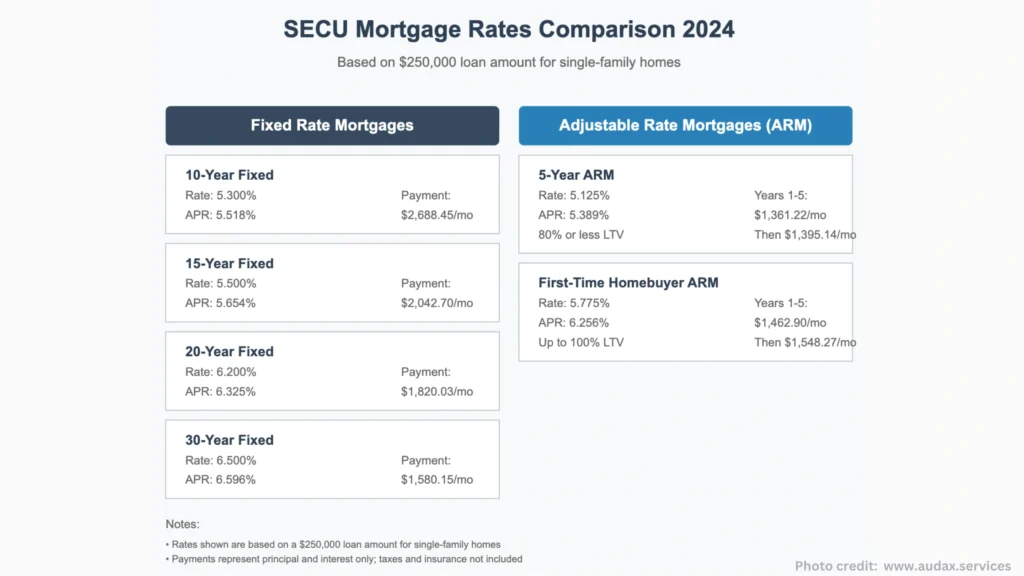

SECU offers various mortgage products with competitive rates based on a $250,000 loan amount for single-family homes. Here are the current rates as of 2024:

Fixed-Rate Mortgages

- 10-Year Fixed Rate (90% or less LTV): 5.300% (5.518% APR)

- 15-Year Fixed Rate (90% or less LTV): 5.500% (5.654% APR)

- 20-Year Fixed Rate (90% or less LTV): 6.200% (6.325% APR)

- 30-Year Fixed Rate (90% or less LTV): 6.500% (6.596% APR)

Adjustable-Rate Mortgages (ARM)

- 5-Year ARM (80% or less LTV): 5.125% (5.389% APR)

- First-Time Homebuyer’s ARM: 5.775% (6.256% APR)

SECU Mortgage Products Overview

Fixed-Rate Mortgages

SECU’s fixed-rate mortgages offer stability and predictability with consistent monthly payments throughout the loan term. These loans are particularly suitable for:

- Long-term homeowners

- Buyers in low-interest-rate markets

- Households with strict budgeting needs

Term Options:

- 10-year fixed

- 15-year fixed

- 20-year fixed

- 30-year fixed

Adjustable-Rate Mortgages

SECU’s 5-Year ARM program provides competitive initial rates with controlled adjustment periods. Key features include:

- Rate adjustments every five years

- 2% cap on rate changes per adjustment

- 6% lifetime cap over initial rate

- Maximum 30-year term

Unique Benefits of SECU Mortgages

No Private Mortgage Insurance (PMI)

Unlike many lenders, SECU doesn’t require PMI on their mortgage products, potentially saving borrowers hundreds of dollars monthly.

Low Fees

- No application fees

- No credit report fees

- Capped origination fees ($2,500 maximum)

Geographic Coverage

SECU provides mortgage services in:

- North Carolina

- South Carolina

- Virginia

- Georgia

- Tennessee

First-Time Homebuyer Programs

SECU offers specialized programs for first-time homebuyers, including:

- No down payment required (up to $500,000 home value)

- Up to $2,000 in closing cost assistance

- Special ARM rates for first-time buyers

Additional Assistance Programs

Through partnerships with the Federal Home Loan Bank of Atlanta, eligible buyers can access:

- First-Time Home Buyer Assistance Program: Up to $12,500 in assistance

- Community Partners Program: Up to $15,000 for qualifying professionals

Application Process and Requirements

Pre-qualification Process

SECU offers no-cost, no-obligation pre-qualifications through multiple channels:

- Online application

- Phone consultation

- In-branch meetings

Required Documentation

Applicants need to provide:

- Income verification

- Employment history

- Asset information

- Credit check consent

- Residential history

Competitive Advantages

Market Position

- Largest mortgage lender in North Carolina

- Competitive rates compared to national averages

- Strong local market presence and expertise

Financial Stability

As a member-owned credit union, SECU maintains high standards of financial stability and member service

Conclusion

State Employees Credit Union offers competitive mortgage rates and unique benefits that make it a strong choice for homebuyers in its service area. With no PMI requirement, low fees, and specialized programs for first-time buyers, SECU provides valuable options for those seeking home financing in the southeastern United States.

To learn more about SECU mortgage rates and options, visit your local branch, call (877) 589-1547, or apply online through the SECU Member Access portal. Get pre-qualified today to start your homebuying journey with confidence.

FAQ Section

Q: What are SECU’s current mortgage rates?

A: Current rates vary by loan type and term, ranging from 5.125% (5.389% APR) for a 5-Year ARM to 6.500% (6.596% APR) for a 30-Year Fixed Rate mortgage, based on a $250,000 loan amount.

Q: Does SECU require private mortgage insurance?

A: No, SECU does not require PMI on their mortgage products, regardless of down payment size.

Q: What states does SECU serve?

A: SECU provides mortgage services in North Carolina, South Carolina, Virginia, Georgia, and Tennessee.

Q: What are the closing costs for a SECU mortgage?

A: Closing costs include an origination fee (capped at $2,500), third-party appraisal fees, title insurance, attorney fees, and other standard closing costs. SECU does not charge application or credit report fees.

Q: How long does pre-qualification take?

A: Pre-qualification letters are typically generated within one business day after completing the application and providing necessary documentation.

In another related article, AmeriSave Mortgage Biweekly Payment Guide