Introduction: The Future of Altcoin Investment in the USA

As we approach 2025, the cryptocurrency landscape continues to evolve, presenting unique opportunities for American investors to diversify their portfolios with promising altcoins. With the digital asset market maturing and regulatory frameworks becoming clearer in the United States, strategic investments in carefully selected altcoins could potentially yield significant returns.

This comprehensive guide examines the top 5 altcoins that show substantial promise for growth by 2025, based on thorough analysis of market trends, technological advancement, and adoption potential within the USA’s regulatory framework.

Understanding Altcoin Investment in 2024-2025

Before diving into specific recommendations, it’s crucial to understand the current state of the altcoin market. The cryptocurrency sector has evolved significantly, with the USA leading in adoption and innovation. The DeFi market alone is projected to grow from $15 billion in 2021 to over $231 billion by 2030, indicating massive potential for growth in the altcoin space.

Key Market Indicators

- Global AI market projection: $1.8 trillion by 2030

- DeFi market growth: Expected to reach $231 billion by 2030

- Blockchain gaming market: Projected to hit $227 billion by 2028

Selection Criteria for Top Altcoins

Our selection process for identifying the most promising altcoins focuses on several crucial factors:

- Technological Innovation

- Market Adoption and Usage

- Development Team Expertise

- Regulatory Compliance in the USA

- Community Support and Growth

- Real-World Use Cases

- Integration Potential with Existing Systems

Top 5 Altcoins with High Growth Potential for 2025

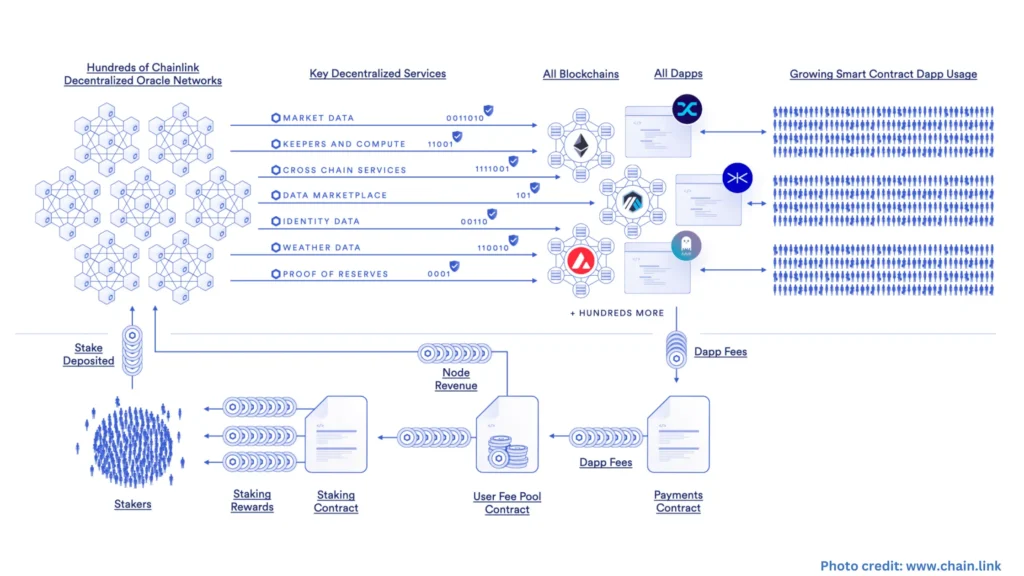

1. Chainlink (LINK)

Why Chainlink Stands Out

Chainlink has established itself as the leading decentralized oracle network, providing essential infrastructure for the growing DeFi ecosystem. Its unique position in the market makes it a strong contender for significant growth by 2025.

Key Features and Advantages

- Market-leading oracle solution

- Extensive partnership network

- Critical DeFi infrastructure

- Strong presence in the USA market

Growth Catalysts

- Expanding DeFi integration

- Cross-chain functionality

- Enterprise adoption

- Smart contract innovation

Price Analysis and Projections

Current market indicators suggest strong potential for growth:

- Support level: $15.75

- Resistance level: $20.00

- Technical indicators showing bullish momentum

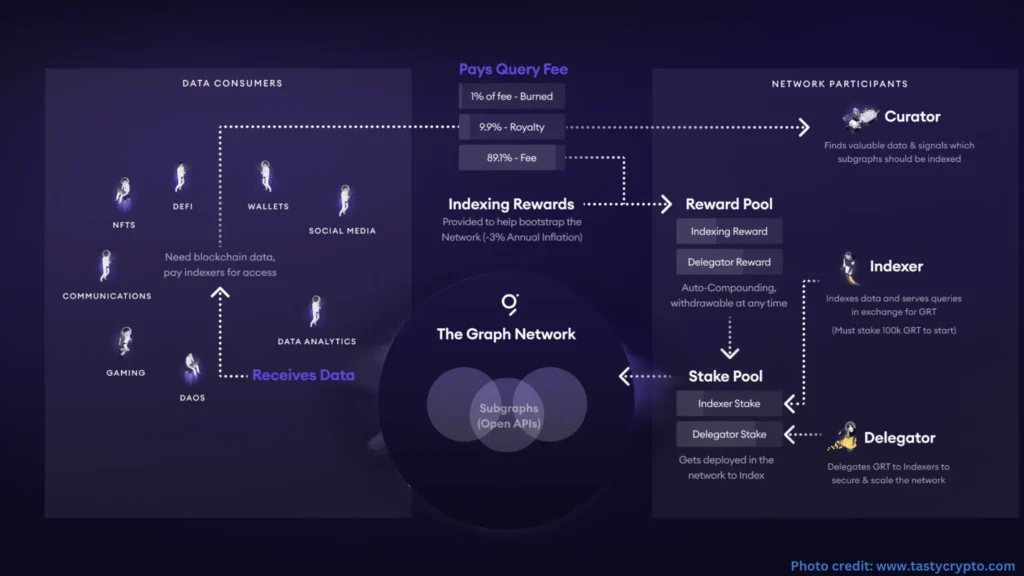

2. The Graph (GRT)

Platform Overview

Known as the “Google of blockchains,” The Graph provides crucial indexing infrastructure for Web3 applications. Its service is becoming increasingly vital as the decentralized internet evolves.

Technical Advantages

- Efficient blockchain data indexing

- Robust query capabilities

- Scalable infrastructure

- Developer-friendly tools

Market Position

- Over 3,000 integrated applications

- Growing developer adoption

- Strong USA presence

- Key Web3 infrastructure provider

Future Outlook

The Graph’s potential for growth is supported by:

- Increasing dApp development

- Web3 adoption acceleration

- Cross-chain expansion

- Enterprise integration opportunities

3. Fetch.ai (FET)

Innovation Focus

Fetch.ai combines AI with blockchain technology, creating a unique platform for autonomous economic agents. This convergence positions it well for future growth.

Technical Capabilities

- AI-powered smart contracts

- Machine learning integration

- Autonomous agent technology

- Cross-chain compatibility

Market Applications

- Supply chain optimization

- Smart city infrastructure

- Automated trading systems

- Energy grid management

Growth Potential

With AI market projections reaching $1.8 trillion by 2030, Fetch.ai is well-positioned to capture significant market share through:

- Industry partnerships

- Technical advancement

- Use case expansion

- Market adoption

4. SingularityNET (AGIX)

Platform Synopsis

SingularityNET represents the future of AI services marketplace, offering a decentralized platform for AI development and deployment.

Key Advantages

- Decentralized AI marketplace

- Democratic development environment

- Cross-platform compatibility

- Strong research foundation

Market Opportunity

- Growing AI service demand

- Enterprise adoption potential

- Academic partnerships

- Innovation in AI deployment

Development Roadmap

The platform’s growth trajectory includes:

- Enhanced AI capabilities

- Expanded service offerings

- Improved scalability

- Greater market penetration

5. LuckHunter (LHUNT)

Platform Innovation

LuckHunter combines blockchain gaming with virtual reality, targeting the rapidly growing gaming and gambling markets.

Unique Features

- VR integration

- Blockchain transparency

- Decentralized gaming

- Player rewards system

Market Potential

The platform is positioned to capitalize on:

- Growing gaming market

- VR technology adoption

- Blockchain gaming trend

- Decentralized gambling demand

Investment Outlook

Current indicators suggest strong growth potential:

- Presale price: $0.001

- Expected listing: $0.005

- Projected market penetration

- Technology adoption curve

Investment Strategy and Portfolio Allocation

Recommended Portfolio Distribution

For optimal risk-adjusted returns, consider the following allocation:

Chainlink (LINK): 25%

- Established market presence

- Critical infrastructure position

- Strong institutional adoption

The Graph (GRT): 20%

- Essential Web3 infrastructure

- Growing developer adoption

- Clear market leadership

Fetch.ai (FET): 20%

- AI market potential

- Innovative technology

- Multiple use cases

SingularityNET (AGIX): 20%

- AI marketplace growth

- Research partnerships

- Development potential

LuckHunter (LHUNT): 15%

- High growth potential

- Gaming market expansion

- Early-stage opportunity

Risk Management and Considerations

Key Risk Factors

Market Volatility

- Price fluctuations

- Market sentiment

- Trading volume variations

Regulatory Environment

- USA compliance requirements

- SEC oversight

- State regulations

Technical Risks

- Smart contract vulnerabilities

- Network security

- Technology adoption challenges

Market Competition

- New entrants

- Technology obsolescence

- Market share challenges

How to Purchase and Store Altcoins

Exchange Selection

Choose regulated USA exchanges:

- Coinbase

- Kraken

- Gemini

- Binance.US

Security Measures

- Two-factor authentication

- Hardware wallet storage

- Regular security audits

- Backup procedures

Conclusion

The altcoin market presents significant opportunities for USA investors looking toward 2025. While risks exist, careful selection and proper portfolio management can help maximize potential returns. The five altcoins discussed – Chainlink, The Graph, Fetch.ai, SingularityNET, and LuckHunter – represent different aspects of blockchain innovation and market potential.

Begin your investment journey by:

- Conducting thorough research

- Consulting financial advisors

- Starting with small investments

- Maintaining a diversified portfolio

Remember that cryptocurrency investments require careful consideration and ongoing monitoring. Stay informed about market developments and regulatory changes affecting your chosen altcoins.

Frequently Asked Questions

Q: What makes these altcoins different from others in the market?

A: These selections combine strong technological foundations, clear use cases, and established market presence, positioning them for potential growth by 2025.

Q: How much should I invest in altcoins?

A: Only invest what you can afford to lose. A common recommendation is 5-10% of your investment portfolio, depending on your risk tolerance.

Q: Are these altcoins regulated in the USA?

A: Each altcoin’s regulatory status varies. Always verify current compliance status and consult with a financial advisor.

Q: What are the tax implications of altcoin investment in the USA?

A: Cryptocurrency investments are subject to capital gains tax. Consult a tax professional for specific guidance.

In another related article, What Charts Should Crypto Investors Use?: The Key to Successful Cryptocurrency Trading and Investing