Introduction

For many American businesses, accessing quick capital through short-term business loans can seem like the most straightforward solution to immediate funding needs. However, these loans often come with significant drawbacks, including higher interest rates, aggressive repayment schedules, and potential strain on cash flow. Fortunately, numerous alternatives exist that can provide more favorable terms and better long-term financial outcomes for your business.

Understanding Short-Term Business Loans: The Baseline

Before exploring alternatives, it’s essential to understand what makes short-term business loans both attractive and potentially problematic. Traditional short-term business loans typically:

- Offer repayment periods of 3-24 months

- Provide quick access to capital

- Feature higher interest rates than long-term options

- Require more frequent payments (often weekly or daily)

- Have less stringent qualification requirements

- Offer smaller maximum loan amounts

Long-Term Business Loans: The Traditional Alternative

Benefits of Long-Term Financing

Long-term business loans represent one of the most stable alternatives to short-term financing. These loans typically offer:

- Repayment terms of 3-10 years

- Lower monthly payments

- More competitive interest rates

- Higher borrowing limits

- More flexible use of funds

Major Providers and Requirements

Leading national banks like Bank of America, Wells Fargo, and Chase offer long-term business loans with varying requirements:

- Minimum credit score: Usually 680+

- Time in business: 2+ years

- Annual revenue: $250,000+

- Collateral: Often required

- Documentation: Comprehensive financial statements and business plans

SBA Loans: Government-Backed Solutions

Types of SBA Loans

The Small Business Administration offers several loan programs that serve as excellent alternatives to short-term financing:

7(a) Loans

- Maximum amount: $5 million

- Terms: Up to 10 years for working capital, 25 years for real estate

- Interest rates: Prime rate + 2.25% to 4.75%

- Use cases: Working capital, equipment, real estate

504 Loans

- Maximum amount: Up to $5.5 million

- Terms: 10, 20, or 25 years

- Interest rates: Below market rates, fixed

- Use cases: Major fixed assets like real estate or equipment

Recent SBA Lending Trends

According to the SBA’s 2024 Capital Report:

- Record-breaking 7(a) loan approvals

- $443,020

- $1,116,667

- Majority of 7(a) loans (54%) under $150,000

- 65% of 504 loans exceed $500,000

READ ALSO: 10 Best Credit Cards for People with Bad Credit

Business Lines of Credit: Flexible Funding Solutions

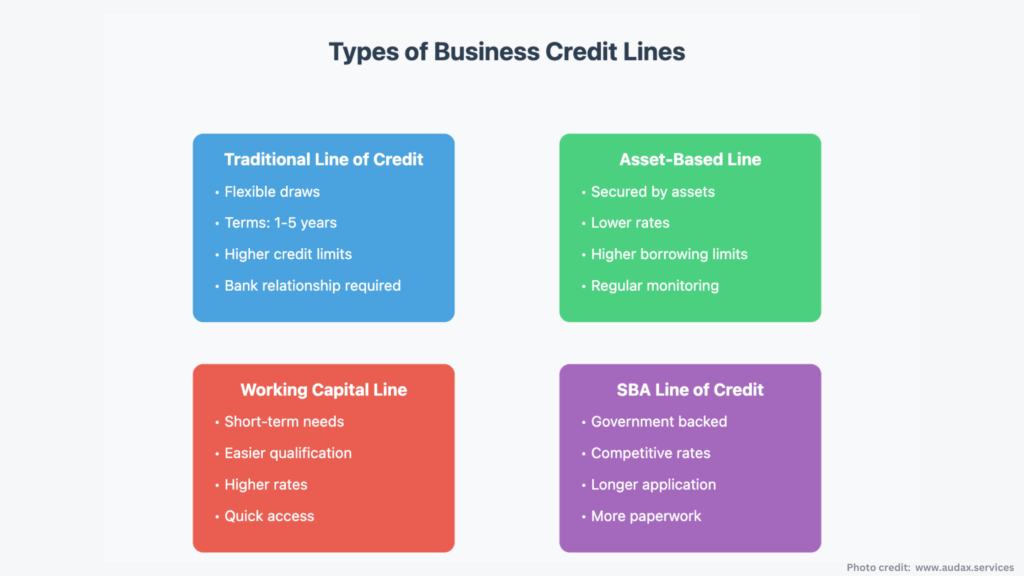

Traditional Lines of Credit

Traditional business lines of credit offer:

- Revolving credit access

- Draw periods of 1-5 years

- Interest only on used funds

- Flexible use of capital

- Building business credit opportunity

Specialized Lines of Credit

Asset-Based Lines

- Secured by inventory or receivables

- Higher credit limits

- Lower interest rates

- More stringent monitoring requirements

Working Capital Lines

- Designed for operational expenses

- Shorter terms

- More flexible qualification requirements

- Higher interest rates than traditional lines

Alternative Financing Solutions

Crowdfunding

Equity Crowdfunding

- Platform options (StartEngine, WeFunder, Republic)

- SEC regulations and requirements

- Typical raise amounts: $50,000 – $5 million

- Investor benefits and obligations

Rewards-Based Crowdfunding

- Popular platforms (Kickstarter, Indiegogo)

- Project-based funding

- No equity dilution

- Marketing opportunities

Peer-to-Peer Lending

- Major platforms (Funding Circle, Prosper)

- Interest rates: 6% – 36%

- Loan amounts: $2,000 – $500,000

- Application requirements and process

Microloans

SBA Microloans

- Maximum amount: $50,000

- Average loan: $13,000

- Terms up to 6 years

- Interest rates: 8% – 13%

Community Development Financial Institutions (CDFIs)

- Focus on underserved communities

- Flexible requirements

- Technical assistance included

- Local economic impact

Business Credit Cards

Benefits

- Immediate access to funds

- Rewards programs

- Build business credit

- Separation of personal/business expenses

Popular Options

- Chase Ink Business Preferred

- American Express Business Gold

- Capital One Spark Cash

- Brex Card for Startups

Business Grants

Federal Grants

- Grants.gov opportunities

- Industry-specific programs

- Research and development funding

- Compliance requirements

Private Grants

- Corporate grant programs

- Industry association awards

- Local chamber of commerce opportunities

- Application strategies

Choosing the Right Alternative

Factors to Consider

Time to Funding

- Immediate needs vs. planned expenses

- Application processing times

- Documentation requirements

Cost of Capital

- Interest rates and APR

- Fees and charges

- Total cost of borrowing

Business Stage and Qualifications

- Time in operation

- Credit score requirements

- Revenue thresholds

- Industry restrictions

Use of Funds

- Working capital

- Equipment purchase

- Real estate

- Expansion

Decision Framework

Create a systematic approach to choosing the right funding alternative:

Assessment Phase

- Document funding needs

- Review business financials

- Check credit scores

- Gather required documentation

Research Phase

- Compare available options

- Request quotes and terms

- Review requirements

- Calculate total costs

Application Phase

- Submit applications

- Respond to information requests

- Review offers

- Negotiate terms

Best Practices for Success

Preparation Tips

Documentation

- Updated financial statements

- Tax returns

- Business plans

- Financial projections

Credit Management

- Monitor business credit

- Address issues proactively

- Maintain separate business accounts

- Build strong banking relationships

Timing Considerations

- Seasonal factors

- Market conditions

- Business cycles

- Growth opportunities

Conclusion

Alternatives to short-term business loans offer various advantages for companies seeking financing. By understanding these options and carefully evaluating your business needs, you can select the most appropriate funding solution that provides better terms and supports long-term growth.

Consider working with a financial advisor or SCORE mentor to evaluate your options and create a strategic funding plan. Remember that combining multiple alternatives might provide the optimal solution for your business’s unique needs.

Ready to explore your business funding options? Contact your local SBA office or SCORE chapter for free guidance on choosing the right alternative for your business needs.

FAQ Section

Q: What credit score do I need for alternatives to short-term business loans?

A: Credit score requirements vary by option. SBA loans typically require 650+, traditional bank loans 680+, while alternative lenders may accept scores as low as 600. Business credit cards often require personal credit scores of 670+.

Q: How long does it take to get approved for these alternatives?

A: Approval times range from instant (business credit cards) to several months (SBA loans). Traditional bank loans typically take 2-4 weeks, while alternative lenders might approve within days.

Q: Can startups qualify for these alternatives?

A: Yes, but options may be limited. Startups often find success with crowdfunding, microloans, business credit cards, and certain alternative lenders. Traditional bank loans and SBA loans typically require 2+ years in business.

Q: What documentation is typically required?

A: Common requirements include:

- Business and personal tax returns

- Financial statements

- Bank statements

- Business plan

- Financial projections

- Personal identification

- Business licenses

Q: How do I choose between multiple loan offers?

A: Compare total cost of borrowing, including fees and interest rates. Consider terms, repayment schedule, and impact on cash flow. Review prepayment penalties and collateral requirements.

In another related article, Funding Circle Small Business Loans