In 2024, finding reliable bad credit dealerships near you doesn’t have to be a challenging journey. With nearly 40% of Americans having a credit score below 600, dealerships across the United States have evolved to offer more inclusive financing options for those facing credit challenges. This comprehensive guide will help you navigate the landscape of bad credit auto financing and find trustworthy dealerships in your area.

Understanding Bad Credit Auto Financing in 2024

The auto financing landscape has transformed significantly in recent years. According to recent data, 99% of applicants at specialized bad credit dealerships receive approval for auto loans, with amounts ranging from $10,000 to $99,999. This shift represents a growing recognition that traditional credit scores don’t tell the whole story of a person’s ability to manage car payments.

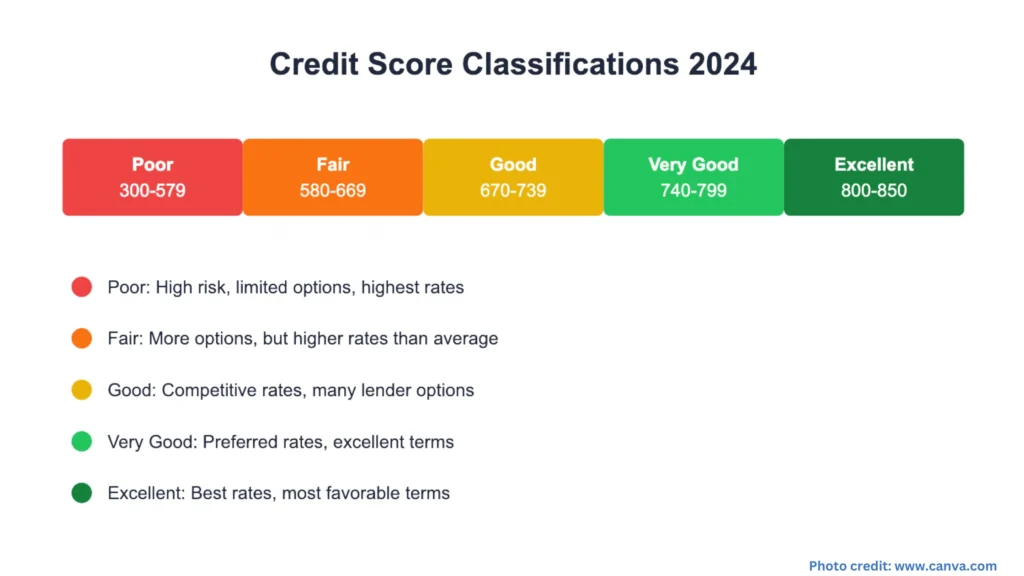

What Qualifies as Bad Credit in 2024?

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

How to Find Reputable Bad Credit Dealerships Near Me in 2024

Online Search Tools and Resources

Modern technology has made finding bad credit dealerships easier than ever. Leading platforms like DriveTime, Auto Credit Express, and CarGurus offer specialized search tools that connect buyers with local dealerships specializing in bad credit financing. These platforms provide:

- Real-time inventory updates

- Pre-qualification tools

- Customer reviews and ratings

- Transparent pricing information

Local Dealership Networks

Many traditional dealerships have developed specialized programs for customers with credit challenges. These programs often include:

- No SSN requirements for pre-approval

- Flexible down payment options

- Special financing departments

- Personalized payment plans

Understanding the Application Process

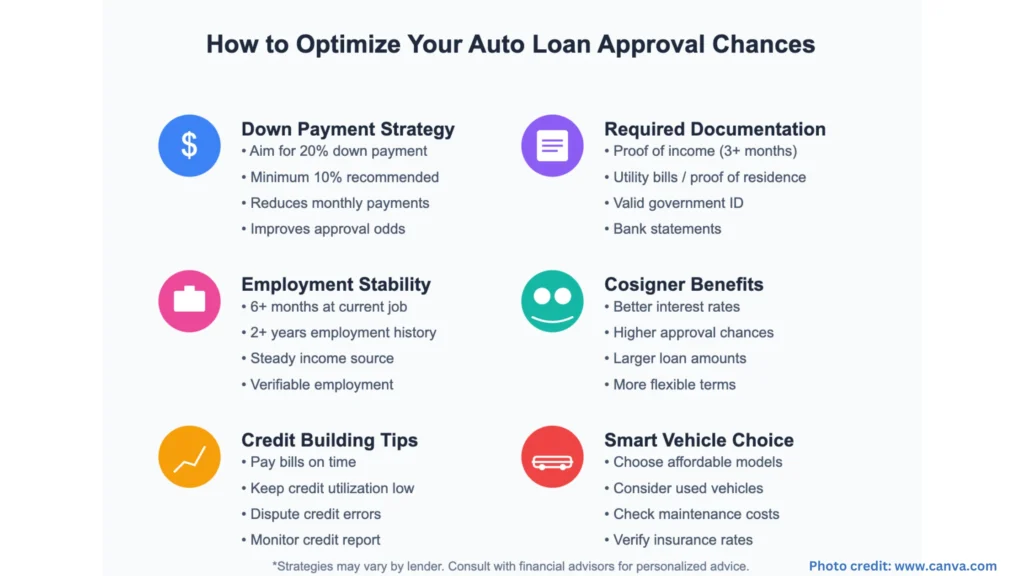

Required Documentation

When visiting bad credit dealerships in 2024, prepare to provide:

- Proof of income (recent pay stubs or tax returns)

- Proof of residence

- Valid government-issued ID

- References

- Down payment (typically 10% or more)

Credit Check Process

Most dealerships perform a “soft pull” during initial inquiries, which won’t affect your credit score. A hard inquiry occurs only when you’re ready to finalize financing.

Improving Your Approval Odds in 2024

Key Strategies

Make a Substantial Down Payment

- Industry standard: 10% minimum

- Recommended: 20% for better terms

- Impact on monthly payments and interest rates

Secure a Qualified Cosigner

- Requirements for cosigners

- Benefits of cosigner arrangements

- Responsibilities and risks

Provide Proof of Stability

- Employment history

- Residence history

- Banking relationships

READ ALSO: How to Get Approved for a Credit Card with Bad Credit in 2024

Understanding Loan Terms and Conditions

Interest Rates

In 2024, bad credit auto loan interest rates typically range from:

- 15% to 29% for credit scores below 580

- 10% to 15% for scores between 580-669

- 6% to 10% for scores above 670

Loan Duration

Standard terms range from 36 to 72 months, with most bad credit loans averaging:

- 48 months for used vehicles

- 60 months for new vehicles

- 72 months for premium vehicles

Building Credit Through Auto Loans

Positive Impact Strategies

- Making timely payments

- Maintaining low credit utilization

- Building payment history

- Improving credit mix

Special Considerations for 2024

Market Trends

- Rising interest rates

- Inventory challenges

- Digital financing options

- Alternative credit scoring models

Consumer Protection

- Understanding your rights

- Avoiding predatory lending

- Identifying red flags

Top Bad Credit Dealership Networks in 2024

National Networks

DriveTime

- 99% approval rate

- Extensive inventory

- Integrated financing solutions

Auto Credit Express

- Specialized bad credit programs

- Nationwide dealer network

- Personal finance managers

CarGurus

- Transparent pricing

- Multiple dealer comparisons

- Pre-qualification tools

Tips for Negotiating at Bad Credit Dealerships

Price Negotiation

- Research market values

- Compare multiple offers

- Focus on total cost, not monthly payments

- Understand dealer markup practices

Financing Negotiation

- Shop multiple lenders

- Understanding APR vs. interest rate

- Reviewing all fees and charges

- Negotiating term length

Common Pitfalls to Avoid

Red Flags

- Pressure tactics

- Hidden fees

- Unclear terms

- Missing documentation

- Unrealistic promises

Alternative Options to Consider

Other Financing Sources

- Credit unions

- Online lenders

- Peer-to-peer lending

- Buy-here-pay-here dealerships

Conclusion

Finding bad credit dealerships near you in 2024 doesn’t have to be overwhelming. With the right preparation, understanding of the process, and knowledge of available options, you can secure financing for your next vehicle despite credit challenges. Remember to:

- Research thoroughly

- Prepare necessary documentation

- Compare multiple offers

- Understand all terms and conditions

- Make informed decisions based on total cost

Ready to start your car-buying journey? Use our dealership locator tool to find bad credit dealerships near you in 2024. Enter your zip code to see available options and get pre-qualified today.

Frequently Asked Questions

Q: What credit score do I need to get approved at a bad credit dealership in 2024?

A: Most bad credit dealerships in 2024 don’t have minimum credit score requirements. However, your score will affect your interest rate and down payment requirements. Many dealers approve scores as low as 450, with some offering options for no credit check financing.

Q: How much should I expect to put down at a bad credit dealership?

A: Most bad credit dealerships require a minimum down payment of 10% of the vehicle’s price. However, putting down 20% or more can significantly improve your approval odds and secure better interest rates.

Q: Can I get approved without a Social Security Number?

A: Yes, many dealerships offer pre-approval without an SSN. However, you’ll need to provide alternative documentation such as proof of income, residence, and valid ID.

Q: How long does the approval process take?

A: In 2024, many bad credit dealerships offer same-day approval decisions. The entire process, from application to driving off the lot, can take as little as 24-48 hours.

Q: Will my interest rate be high with bad credit?

A: Interest rates for bad credit auto loans typically range from 15% to 29%. However, factors like down payment size, loan term, and vehicle type can affect your rate.

In another related article, How to Get Approved for a Credit Card with Bad Credit in 2024