Introduction

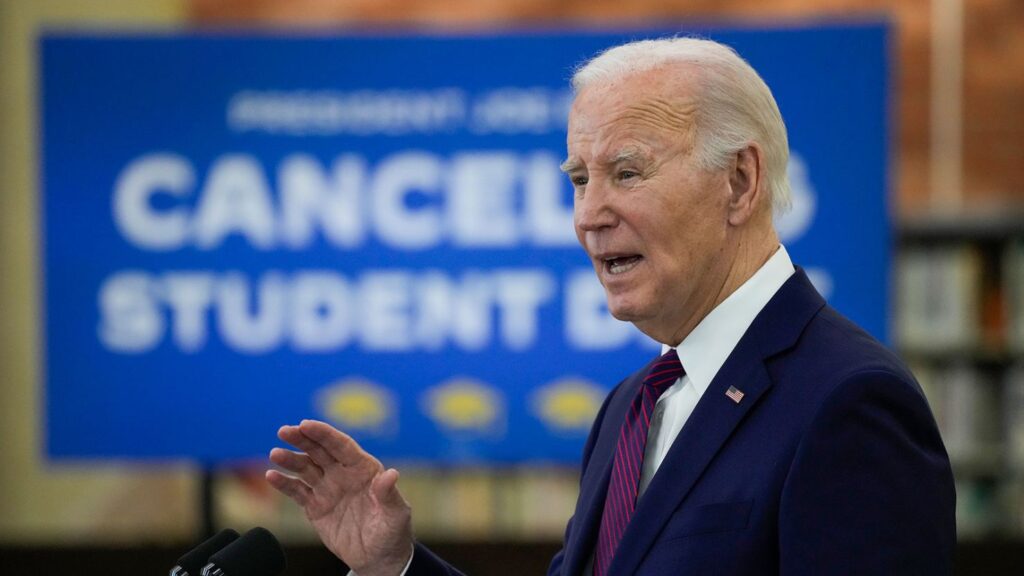

The ongoing student debt crisis in the United States has been a contentious issue, prompting policymakers and stakeholders to seek viable solutions. President Biden’s ambitious plan to provide student loan forgiveness has sparked widespread discussions, with opinions diverging on its effectiveness, fairness, and potential implications. As the debate rages on, it is crucial to delve into the intricacies of the Biden student loan forgiveness, examining its eligibility criteria, potential impact, and the complexities surrounding its implementation.

The Need for Student Loan Relief

According to the latest statistics, the total outstanding student loan debt in the United States stands at a staggering $1.7 trillion, with over 43 million borrowers grappling with the burden of repayment. The rising cost of higher education, coupled with stagnant wage growth, has made it increasingly challenging for many individuals to repay their loans, hindering their ability to build wealth and achieve financial stability.

Recognizing the gravity of this issue, the Biden administration has made student loan forgiveness a key priority, aiming to alleviate the financial strain on borrowers and foster a more equitable education system. However, the path to implementing this relief has been fraught with legal challenges and controversies, highlighting the complexities inherent in such an ambitious undertaking.

READ ALSO: Wells Fargo Exits Student Loan Industry: What it Means for Borrowers

Biden’s Student Loan Forgiveness Plan: An Overview

In August 2022, President Biden announced a sweeping student loan forgiveness plan, promising to cancel up to $20,000 in federal student loan debt for eligible borrowers. The plan aimed to provide relief to individuals earning less than $125,000 per year or households earning less than $250,000. Additionally, borrowers who received Pell Grants, a form of need-based federal aid, were eligible for an additional $10,000 in loan cancellation, totaling $20,000.

The relief would apply to federal student loans taken out for undergraduate and graduate studies, as well as Parent PLUS loans. Current students would also qualify if their loans were issued before July 1, 2022.

Eligibility Criteria and Application Process

Income Eligibility

To be eligible for the $10,000 loan forgiveness, borrowers must have an individual income below $125,000 or a household income below $250,000. Borrowers had the option to use either their 2020 or 2021 tax return information to determine income eligibility, allowing for flexibility in cases where incomes may have changed due to the COVID-19 pandemic.

For current students, the Department of Education would use income data from the Free Application for Federal Student Aid (FAFSA) for the 2021-2022 academic year.

Loan Types and Borrower Status

The loan forgiveness plan applied to federal student loans, including Direct Loans (subsidized and unsubsidized), Parent PLUS loans, and Graduate PLUS loans. However, it did not cover private student loans or certain older federal loan programs, such as the Federal Family Education Loan (FFEL) Program or the Federal Perkins Loan Program, unless those loans were consolidated into the Direct Loan program.

Both current students and borrowers who had already completed their studies were eligible for relief, provided their loans were disbursed on or before June 30, 2022.

Application Process

The Department of Education initially launched an online application process for borrowers to apply for loan forgiveness. However, due to legal challenges, the application process was temporarily halted, with the administration encouraging borrowers to sign up for updates on the Federal Student Aid website to stay informed about the program’s status and potential reopening of applications.

For borrowers whose income data was already available to the Department of Education, such as those enrolled in income-driven repayment plans, loan forgiveness may have been applied automatically without the need for an application.

Legal Challenges and the Supreme Court’s Ruling

President Biden’s student loan forgiveness plan faced numerous legal challenges from various states and organizations, with critics arguing that the administration overstepped its executive authority and that the plan would have significant economic impacts.

In June 2023, the U.S. Supreme Court struck down the plan in a 6-3 decision, ruling that the administration lacked the legal authority to implement the forgiveness program. The court’s conservative majority argued that the plan represented an unconstitutional exercise of Congress’s legislative power and that the Heroes Act of 2003, which the president cited in taking the executive action, did not provide clear authorization for the loan forgiveness initiative.

This ruling marked a significant setback for the Biden administration’s efforts to provide large-scale student loan debt relief, leaving millions of borrowers in limbo and reigniting debates about alternative approaches to addressing the nation’s student debt crisis.

Alternative Approaches and Future Implications

Following the Supreme Court’s ruling, the Biden Administration and Congress have continued to explore alternative avenues for addressing student loan debt. One approach being considered is expanding and improving existing income-driven repayment (IDR) plans, which could lead to more borrowers receiving forgiveness after making qualifying payments over an extended period.

Another proposal, the Student Tax Relief Act, seeks to permanently exclude all canceled student debt from taxable income. This would address the complexities and potential inequities arising from the current tax treatment of forgiven loans, where lenders can deduct the cost of forgiven loans while borrowers may face tax liabilities in some cases.

Additionally, the administration has announced plans to cancel $1.2 billion in federal student loan debt for 153,000 borrowers enrolled in the new income-driven repayment (IDR) plan named SAVE (Saving on a Valuable Education). Under this plan, borrowers who originally borrowed $12,000 or less for college and have made at least 10 years of payments would be eligible for debt cancellation. Borrowers may receive debt discharge for every additional $1,000 borrowed above $12,000 after an extra year of payments.

While these alternative approaches aim to provide relief to borrowers, they also highlight the ongoing challenges and complexities associated with student loan debt. Concerns remain about the long-term sustainability of such measures, the potential burden on taxpayers, and the implications for higher education financing and student borrowing behavior.

To Recap

The Biden administration’s student loan forgiveness plan, while well-intentioned, faced significant legal and political hurdles, culminating in its rejection by the Supreme Court. However, the ongoing debate surrounding student debt relief underscores the urgency of finding viable solutions to address the mounting financial burden faced by millions of borrowers.

As policymakers and stakeholders explore alternative approaches, it is crucial to strike a balance between providing targeted relief to those most in need and ensuring the long-term sustainability and fairness of such initiatives. Expanding and improving existing income-driven repayment plans, addressing the complexities in the tax treatment of forgiven debt, and promoting responsible borrowing practices could pave the way for a more comprehensive and equitable approach.

Furthermore, it is essential to address the root causes of the student debt crisis, such as the rising costs of higher education and the persistent wage stagnation that hinders borrowers’ ability to repay their loans. Investing in affordable and accessible education, promoting financial literacy, and fostering an environment that supports economic growth and wage mobility could help alleviate the burden of student debt in the long run.

As the nation grapples with the complexities of student loan forgiveness, it is evident that a multifaceted and collaborative approach is necessary. By engaging diverse stakeholders, fostering open dialogue, and remaining committed to finding sustainable solutions, we can work towards a future where higher education remains accessible and attainable without the looming threat of crippling debt.

Frequently Asked Questions

What happens to borrowers who continued making payments during the pandemic pause?

Borrowers who made voluntary payments during the COVID-19 payment pause would not have received a refund or credit for those payments under the initial plan. However, their loan balances would have been reduced accordingly, potentially resulting in a lower amount of forgiveness if their remaining balance was less than the eligible forgiveness amount.

Would the forgiven debt have been considered taxable income?

No, the forgiven student loan debt would not have been considered taxable income at the federal level. The American Rescue Plan Act of 2021 exempted student loan forgiveness from federal income taxation through 2025.

However, some states, such as Indiana, North Carolina, and Mississippi, had indicated that they would treat forgiven student loans as taxable income, while other states were still determining their approach.

What if a borrower didn’t complete their degree?

Completion of a degree was not a requirement for the loan forgiveness plan. Borrowers who did not finish their degree but had eligible federal student loans would still have qualified for relief.

How would the plan have affected borrowers with private student loans?

The Biden Administration’s loan forgiveness plan did not apply to borrowers with private student loans. Only federal student loans held by the U.S. Department of Education were eligible for forgiveness under this plan.

What if a borrower was in default on their loans?

The Department of Education did not provide clear guidance on whether borrowers in default on their federal student loans would have been eligible for forgiveness under the initial plan. However, the administration’s “fresh start” initiative aimed to help borrowers in default access affordable repayment plans and potentially regain eligibility for forgiveness programs.

In another related article, Cup Loan Program: Eligibility, Benefits & Providers