Introduction

Choosing the right mortgage lender is one of the most crucial decisions in your homebuying journey. As you navigate this important financial decision, you’ll likely encounter two main categories of lenders: national institutions that operate across the country and local lenders that focus on specific geographic areas. Each option comes with its own set of advantages and considerations that can significantly impact your home-buying experience.

In this comprehensive guide, we’ll explore the key differences between national and local mortgage lenders, helping you make an informed decision that aligns with your financial goals and personal preferences.

Understanding the Modern Mortgage Lending Landscape

The Evolution of Mortgage Lending

The mortgage lending industry has undergone significant transformation in recent years, driven by technological advancement and changing consumer preferences. National lenders have embraced digital innovation, offering streamlined online applications and automated underwriting processes. Meanwhile, local lenders have adapted by combining traditional relationship-based services with modern technological solutions to remain competitive.

Market Share and Industry Trends

Recent industry data shows that while national lenders dominate the market in terms of volume, local lenders maintain a strong presence, particularly in suburban and rural areas. The mortgage market has seen increased competition between these two segments, leading to more options and better terms for consumers.

National Mortgage Lenders: A Detailed Analysis

Defining Characteristics

National mortgage lenders operate across multiple states and typically fall into one of three categories:

- Large commercial banks (e.g., Bank of America, Wells Fargo)

- Online-only lenders (e.g., Rocket Mortgage)

- National mortgage companies

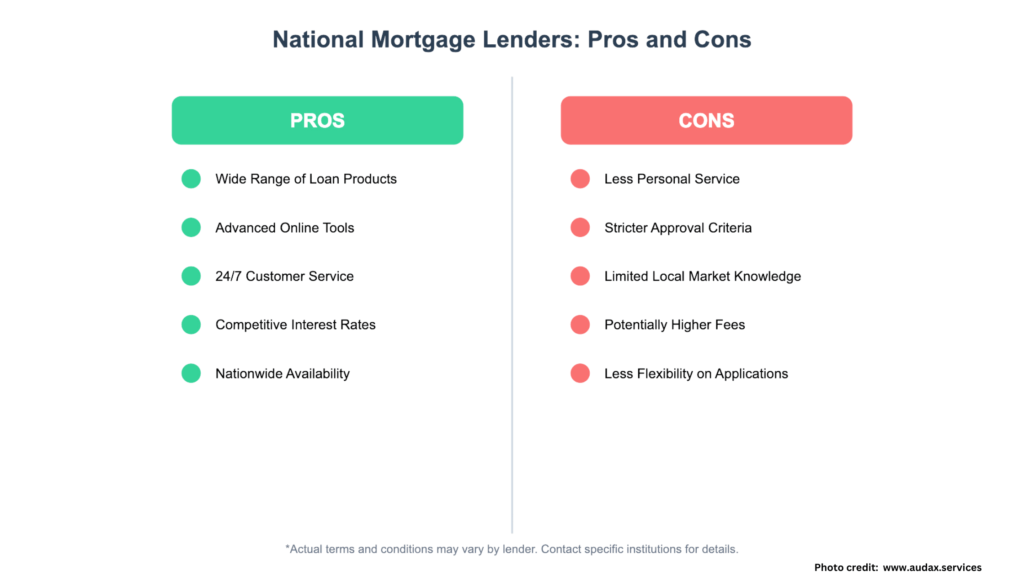

Strengths of National Lenders

1. Extensive Product Range

National lenders typically offer a comprehensive selection of mortgage products, including:

- Conventional loans

- FHA loans

- VA loans

- Jumbo loans

- Specialized mortgage products

2. Technological Infrastructure

- Advanced online application platforms

- Mobile apps for loan management

- 24/7 customer service availability

- Digital document submission and processing

3. Competitive Rates and Terms

- Ability to leverage economies of scale

- Access to broader capital markets

- Potentially lower overhead costs per loan

- Frequent promotional offers and rate specials

Limitations of National Lenders

1. Standardized Approach

- Less flexibility in underwriting decisions

- Stricter adherence to conventional guidelines

- Limited ability to consider unique circumstances

2. Customer Service Considerations

- Less personal attention

- Potential for longer response times

- Multiple points of contact throughout the process

Local Mortgage Lenders: In-Depth Examination

Defining Characteristics

Local mortgage lenders typically operate within specific geographic regions and include:

- Community banks

- Credit unions

- Regional mortgage companies

- Independent mortgage brokers

Advantages of Local Lenders

1. Personalized Service

- Face-to-face interactions

- Consistent point of contact

- Understanding of individual circumstances

- Relationship-based lending approach

2. Local Market Expertise

- Deep knowledge of regional real estate trends

- Familiarity with local property values

- Understanding of area-specific lending programs

- Strong relationships with local real estate professionals

3. Flexible Underwriting

- Ability to consider unique situations

- Manual underwriting capabilities

- Creative solutions for complex scenarios

- Greater discretion in decision-making

Challenges with Local Lenders

1. Limited Resources

- Fewer technological tools

- Potentially longer processing times

- Limited product selection

- Geographic restrictions

2. Market Constraints

- May have higher overhead costs

- Potentially higher rates or fees

- Limited ability to compete on price

- Smaller lending capacity

Making the Right Choice: Decision Factors

Assessment Criteria

1. Personal Preferences

- Comfort with technology vs. face-to-face interaction

- Desired level of personal attention

- Communication style preferences

- Schedule and availability requirements

2. Financial Considerations

- Interest rates and APR

- Closing costs and fees

- Down payment requirements

- Available loan programs

3. Property Factors

- Location of desired property

- Type of property

- Purchase price

- Unique property characteristics

4. Individual Circumstances

- Credit profile

- Employment situation

- Down payment availability

- Time constraints

Special Considerations for Different Borrower Types

First-Time Homebuyers

- Benefits of personalized guidance

- Importance of educational resources

- Access to first-time homebuyer programs

- Need for clear communication

Self-Employed Borrowers

- Documentation requirements

- Flexibility in income verification

- Understanding of business structures

- Creative lending solutions

Military Veterans

- Access to VA loans

- Understanding of military benefits

- Experience with service-related circumstances

- Deployment considerations

Technology and the Lending Experience

Digital Tools and Services

- Online applications

- Document upload capabilities

- E-signing options

- Mobile apps and portals

The Human Element

- Personal assistance

- Complex situation handling

- Emotional support

- Local market insights

Comparing Costs and Fees

Understanding Fee Structures

- Origination fees

- Application fees

- Processing fees

- Underwriting fees

- Rate lock fees

Total Cost Comparison

- Interest rates

- Points

- Closing costs

- Ongoing servicing fees

- Potential future costs

The Application Process Compared

National Lenders

- Online application submission

- Automated underwriting review

- Document collection

- Processing and approval

- Closing coordination

Local Lenders

- Initial consultation

- Application completion

- Personal underwriting review

- Local processing

- Direct closing coordination

Conclusion

The choice between national and local mortgage lenders ultimately depends on your individual circumstances, preferences, and needs. National lenders excel in technological convenience and product variety, while local lenders offer personalized service and market expertise. Consider your priorities carefully and evaluate multiple options before making your decision.

Ready to start your mortgage journey? Contact several lenders from both categories to compare offers and find the best fit for your home-buying needs.

Frequently Asked Questions

Are interest rates always better with national lenders?

Not necessarily. While national lenders may have access to broader capital markets, local lenders often offer competitive rates and may have more flexibility in pricing for specific situations.

How important is face-to-face interaction in the mortgage process?

The importance varies by individual preference and the complexity of the loan scenario. Some borrowers value personal interaction highly, while others prefer the convenience of digital processes.

Can local lenders handle jumbo loans and other specialized mortgage products?

Many local lenders do offer jumbo loans and specialized products, though their selection may be more limited than national lenders.

What advantages do online lenders offer compared to traditional banks?

Online lenders often provide faster processing times, convenient digital tools, and potentially lower rates due to reduced overhead costs.

How do I evaluate a lender’s reputation and reliability?

Research online reviews, check regulatory databases, ask for references, and consider the lender’s history in your community.

In another related article, Top Mortgage Lenders in Sacramento for First-Time Buyers