The investment landscape has undergone a remarkable transformation in recent years, with fractional share investing standing out as one of the most significant democratizing forces in the market. Once limited by the need to purchase whole shares—often at prohibitive prices for many would-be investors—the market has evolved to allow participation with just a few dollars. As we navigate through 2025, fractional share investing has become a cornerstone strategy for both novice investors entering the market and seasoned professionals seeking precise portfolio allocations.

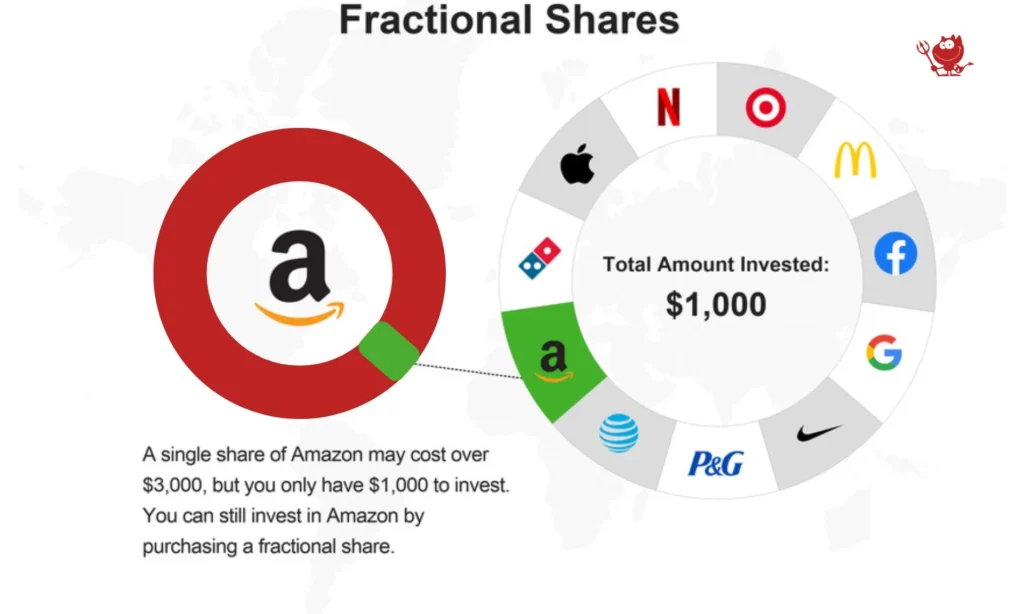

Fractional shares allow investors to purchase portions of stocks and ETFs, making high-priced securities like Amazon, Berkshire Hathaway, and Google’s parent company Alphabet accessible to everyone. This innovation has fundamentally changed how Americans approach investing, enabling greater diversification with smaller amounts of capital and opening doors for systematic investment strategies like dollar-cost averaging.

In this comprehensive guide, we’ll explore the best brokerages offering fractional share investing in 2025, analyzing their offerings, unique features, fee structures, and platform capabilities. Whether you’re a first-time investor with $10 to spare or a sophisticated trader looking to optimize a six-figure portfolio, this analysis will help you identify the perfect brokerage partner for your fractional investment journey.

Understanding Fractional Share Investing

What Are Fractional Shares?

Fractional shares are exactly what they sound like—portions of a single share of stock or ETF that allow investors to own less than one complete share. For example, if a stock trades at $1,000 per share but you only have $100 to invest, fractional shares enable you to purchase 0.1 shares of that company.

This innovation has transformed the accessibility of premium stocks. Consider Berkshire Hathaway’s Class A shares (BRK.A), which traded at over $600,000 per share in early 2025—clearly out of reach for most individual investors. With fractional investing, someone could invest just $50 in this previously inaccessible security.

Benefits of Fractional Share Investing

Fractional shares offer numerous advantages that have contributed to their surging popularity:

- Lower Financial Barriers: Investors can start with minimal capital, making investing accessible to nearly everyone.

- Enhanced Portfolio Diversification: Even with a modest investment budget, you can spread capital across numerous companies rather than concentrating in just a few affordable stocks.

- Precise Asset Allocation: Investors can achieve exact percentage allocations in their portfolios without having to round up or down to whole shares.

- Dollar-Cost Averaging Made Easy: Regular fixed-dollar investments become seamless, even with high-priced securities.

- Full Dividend Participation: Fractional shareholders receive proportional dividends, allowing investors to benefit from income-generating stocks regardless of portfolio size.

- Educational Value: New investors can gain real market experience with minimal risk by starting with small fractional positions.

The Evolution of Fractional Share Offerings

While some brokers have offered fractional shares indirectly through dividend reinvestment plans (DRIPs) for decades, direct fractional share purchasing is a relatively recent development. Initially pioneered by fintech startups seeking to differentiate themselves from established brokers, fractional shares have now been widely adopted across the industry.

The competitive landscape has evolved significantly since 2020, with major traditional brokerages adding fractional capabilities to their platforms. As we enter 2025, the differentiation among brokers offering fractional shares has shifted from simple availability to the breadth of eligible securities, minimum investment requirements, and integration with other platform features.

Top Brokers for Fractional Share Investing in 2025

After extensive research and analysis of the current brokerage landscape, we’ve identified the top brokers for fractional share investing. These selections are based on several key criteria: the range of fractional-eligible securities, minimum investment requirements, user experience, additional platform features, and overall value proposition.

1. Fidelity Investments: Best Overall Broker for Fractional Shares

Fractional Offering Highlights:

- Securities Available: 7,000+ stocks and ETFs

- Minimum Investment: $1

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Program Name: Stocks by the Slice

Fidelity has established itself as the gold standard for fractional share investing in 2025. The broker offers an impressive selection of over 7,000 eligible stocks and ETFs for fractional purchases—one of the most comprehensive offerings in the industry. With a minimum investment requirement of just $1, Fidelity makes fractional investing accessible to virtually everyone.

What truly distinguishes Fidelity is its exceptional integration of fractional capabilities throughout its ecosystem. The “Basket Portfolios” feature allows investors to create personalized collections of stocks, including fractional shares, that can be managed as unified entities. These baskets support automated recurring investments and one-click rebalancing, significantly streamlining portfolio management for fractional investors.

Fidelity’s fractional trading is available across all its platforms—web, desktop, and mobile—with a consistent, intuitive user experience. The order entry process is remarkably straightforward, allowing investors to specify either a dollar amount or a precise number of shares to three decimal places.

Beyond fractional capabilities, Fidelity delivers a complete package with zero-commission trading, industry-leading research tools, exceptional customer service, and a high-yield cash sweep program that automatically moves uninvested cash into higher-yielding options. For investors seeking expense-ratio-free index funds to complement their fractional stock positions, Fidelity’s zero-fee index funds provide additional value.

Why Choose Fidelity for Fractional Shares: For investors prioritizing a comprehensive, well-integrated fractional share experience backed by a full-service brokerage with best-in-class research and tools, Fidelity represents the premier option in 2025.

2. Interactive Brokers: Best for Global Fractional Investing

Fractional Offering Highlights:

- Securities Available: 10,000+ stocks, ETFs, and ADRs

- Minimum Investment: $1

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- International Offering: US, Canadian, European stocks

Interactive Brokers (IBKR) stands out as the premier choice for investors seeking global fractional share opportunities. While most brokers limit fractional trading to U.S. securities, IBKR extends this capability to Canadian and European stocks and ETFs, as well as American Depositary Receipts (ADRs) representing international companies.

This international reach makes IBKR uniquely valuable for investors looking to construct globally diversified portfolios using fractional shares. With over 10,000 eligible securities across multiple markets, IBKR offers the broadest selection of fractional options in 2025.

The broker provides two service tiers relevant to fractional investors: IBKR Lite, offering commission-free trading of U.S. stocks and ETFs, and IBKR Pro, featuring tiered or fixed commission structures that appeal to more active traders. Fractional share purchases are available on both tiers, with the same commission structure as whole-share trading.

IBKR’s fractional functionality is available across its platforms, including the professional-grade Trader Workstation (TWS) desktop platform and the more accessible IBKR GlobalTrader mobile app. The broker’s impressive trading technology ensures reliable execution quality for both fractional and whole-share orders.

Beyond fractional capabilities, Interactive Brokers offers sophisticated tools for portfolio analysis, risk assessment, and tax optimization. Its margin rates consistently rank among the lowest in the industry, and its securities lending program allows eligible investors to earn additional income by lending shares they own.

Why Choose Interactive Brokers for Fractional Shares: Investors seeking global diversification through fractional shares, particularly those interested in both U.S. and international markets, will find IBKR’s comprehensive offering unmatched by competitors in 2025.

3. Public.com: Best Social Investing Experience with Fractional Shares

Fractional Offering Highlights:

- Securities Available: Thousands of stocks and ETFs

- Minimum Investment: $1

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Social investing community

Public.com has carved out a distinctive niche by combining fractional share investing with a vibrant social community. The platform allows investors to purchase fractional shares of thousands of stocks and ETFs with a minimum investment of just $1, while also engaging with a community of like-minded investors.

What sets Public apart is its social feed, where users can share their investment decisions, discuss market trends, and learn from each other’s strategies. This social dimension adds an educational layer to fractional investing that’s particularly valuable for newer investors. The platform also features “Public Themes”—curated collections of stocks and ETFs organized around specific trends, industries, or values—making it easier for fractional investors to discover investment opportunities aligned with their interests.

Public offers commission-free trading and has enhanced its offering with a robust suite of educational resources specifically designed for fractional investors. The platform’s clean, intuitive interface prioritizes accessibility, making it approachable for first-time investors while still offering enough depth for more experienced users.

In 2025, Public has further distinguished itself by offering an impressive selection of alternative assets alongside traditional securities, allowing fractional investors to diversify beyond stocks and ETFs. The platform also provides a competitive interest rate on uninvested cash, enhancing the overall value proposition.

Why Choose Public for Fractional Shares: For investors who value community engagement and social learning alongside their fractional investing activities, Public.com offers a unique combination of accessible fractional trading and social features unmatched by traditional brokers.

4. Charles Schwab: Best for S&P 500 Fractional Investing

Fractional Offering Highlights:

- Securities Available: ~500 (all stocks in the S&P 500)

- Minimum Investment: $5

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Program Name: Stock Slices

Charles Schwab, one of the most established names in the brokerage industry, offers fractional shares through its “Stock Slices” program. While more limited in scope than some competitors—covering only stocks in the S&P 500 index—Schwab delivers a refined experience for investors focused on blue-chip American companies.

The Stock Slices program allows investors to purchase fractional shares of any S&P 500 company with a minimum investment of $5. Notably, Schwab allows the purchase of up to 30 different slices in a single transaction, facilitating one-step diversification across multiple large-cap stocks.

Schwab’s fractional offering is seamlessly integrated into its trading platforms, which have been significantly enhanced following the acquisition of TD Ameritrade. Schwab customers now have access to the powerful thinkorswim platform, providing advanced charting and analysis tools that complement the fractional investing experience.

Beyond fractional shares, Schwab offers a comprehensive suite of financial services, including robust research and educational resources, branch-based support, and integrated banking features. For investors seeking to combine fractional stock investing with index fund strategies, Schwab’s low-cost index funds and ETFs provide excellent complementary options.

Why Choose Charles Schwab for Fractional Shares: Investors primarily interested in building portfolios around S&P 500 companies will appreciate Schwab’s focused approach to fractional investing, especially when combined with the broker’s exceptional research resources and newly acquired thinkorswim platform.

5. Robinhood: Best Mobile-First Experience for Fractional Shares

Fractional Offering Highlights:

- Securities Available: Thousands of stocks and ETFs above volume/size thresholds

- Minimum Investment: $1

- Fractional Purchases: Yes (down to 1/1,000,000th of a share)

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Exceptionally granular fractional purchases

Robinhood pioneered commission-free trading and has evolved its fractional share capabilities to remain competitive in 2025. The platform offers fractional shares of thousands of stocks and ETFs, with an industry-leading level of granularity—allowing purchases as small as one-millionth of a share.

Stocks eligible for fractional trading on Robinhood must trade above $1 per share and have a market capitalization exceeding $25 million, ensuring a broad selection while maintaining quality standards. The platform’s streamlined mobile-first design makes fractional investing particularly intuitive, with a clean interface that simplifies the process of building a portfolio one slice at a time.

Robinhood has enhanced its fractional offering with automatic dividend reinvestment and recurring investments, allowing for consistent portfolio building over time. The platform also offers a competitive interest rate on uninvested cash through its cash management feature, adding value for fractional investors who maintain cash positions.

In 2025, Robinhood has further differentiated itself by offering fractional shares of cryptocurrency alongside traditional securities, creating unique diversification opportunities. The platform’s subscription service, Robinhood Gold, provides additional features for more active fractional investors, including enhanced market data and research resources.

Why Choose Robinhood for Fractional Shares: Investors who prioritize a mobile-first experience with exceptional ease of use and the ability to make extremely precise fractional purchases will find Robinhood’s offering particularly compelling.

6. J.P. Morgan Self-Directed Investing: Best for Banking Integration

Fractional Offering Highlights:

- Securities Available: Thousands of stocks and ETFs

- Minimum Investment: $1

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Seamless integration with Chase banking

J.P. Morgan Self-Directed Investing has emerged as a strong contender in the fractional shares space, particularly for investors who already bank with Chase. The platform offers fractional shares of thousands of stocks and ETFs with a minimum investment of just $1, making it accessible to investors at all levels.

What distinguishes J.P. Morgan is the seamless integration between its investing platform and Chase banking services. Users can easily move money between their bank accounts and investment accounts, set up automatic investments from their checking accounts, and view their entire financial picture in one place. This integration significantly streamlines the process of regular fractional investing through systematic investment plans.

The platform offers commission-free trading and has invested heavily in educational resources specifically tailored to fractional investors. While the trading platform itself is more streamlined than some competitors’ offerings, its simplicity makes it particularly approachable for newer investors exploring fractional shares for the first time.

A standout feature for Chase customers is the availability of in-person support at Chase branches nationwide—something most digital-first brokers can’t match. This combination of digital convenience and physical presence adds a unique dimension to the fractional investing experience.

Why Choose J.P. Morgan for Fractional Shares: For investors who prioritize integration with their existing banking relationship, particularly Chase customers, J.P. Morgan offers a compelling fractional share experience with the added benefit of potential in-person support.

7. Firstrade: Best for Options Traders Using Fractional Shares

Fractional Offering Highlights:

- Securities Available: 4,000+ stocks and ETFs

- Minimum Investment: $5

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Commission-free options trading alongside fractional shares

Firstrade has carved out a distinct position by offering both fractional share investing and commission-free options trading—a combination that appeals to investors looking to implement sophisticated strategies. The broker provides fractional shares for over 4,000 stocks and ETFs with a minimum investment of $5.

This unique pairing allows investors to build diversified portfolios of fractional shares while also engaging in options strategies on those same securities. For example, an investor could build a position in a high-priced stock through fractional purchases while simultaneously selling covered calls on the accumulated position once it reaches whole-share thresholds.

Firstrade’s platforms support both fractional investing and options trading with specialized tools for position management and risk assessment. The broker has also invested in educational resources to help investors understand how these different approaches can complement each other.

Beyond these core offerings, Firstrade distinguishes itself with support for Chinese-language investors, making it particularly valuable for multilingual households. The broker also offers a competitive interest rate on cash balances and supports tax-efficient investing through specialized portfolio analysis tools.

Why Choose Firstrade for Fractional Shares: Investors interested in combining fractional share investing with options strategies will find Firstrade’s unique combination of offerings particularly valuable, especially given the absence of commissions for both activities.

8. SoFi Active Investing: Best for Young Investors Starting with Fractional Shares

Fractional Offering Highlights:

- Securities Available: 4,000+ stocks and ETFs

- Minimum Investment: $5

- Fractional Purchases: Yes

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Integrated financial services ecosystem

SoFi Active Investing has established itself as an appealing option for younger investors entering the market through fractional shares. The platform offers fractional investing across more than 4,000 stocks and ETFs with a minimum investment of $5.

What sets SoFi apart is its comprehensive ecosystem of financial services surrounding the investing experience. Members can access banking services, student loan refinancing, personal loans, and financial planning alongside their fractional investing activities. This integrated approach is particularly valuable for younger investors seeking to build comprehensive financial plans around their early investing efforts.

SoFi’s automated investing option complements its fractional trading capabilities, allowing investors to combine self-directed fractional positions with professionally managed portfolios. The platform also offers competitive interest rates on cash balances and has introduced cryptocurrency trading alongside traditional securities, providing additional diversification options.

Educational resources are a particular strength for SoFi, with content specifically designed for first-time investors using fractional shares to build their initial portfolios. The platform regularly hosts educational events and webinars focused on fractional investing strategies and fundamental financial concepts.

Why Choose SoFi for Fractional Shares: For younger investors seeking to build their first investment portfolios alongside a comprehensive suite of financial services, SoFi’s integrated approach and educational focus make it a compelling choice for fractional investing in 2025.

9. Tastytrade: Best for Active Traders Using Fractional Shares

Fractional Offering Highlights:

- Securities Available: Thousands of stocks and ETFs

- Minimum Investment: $5

- Fractional Purchases: Yes (market orders only)

- Fractional Dividend Reinvestment: Yes

- Unique Feature: Sophisticated trading tools and educational content

Tastytrade has evolved from an options-focused platform to offer a compelling fractional share experience for active traders. The broker provides fractional shares of thousands of stocks and ETFs with a minimum investment of $5, though fractional orders are limited to market orders rather than limit orders.

What distinguishes Tastytrade is its sophisticated trading platform and extensive educational content focused on probability-based trading. While many fractional share platforms target beginners, Tastytrade provides advanced tools that appeal to more experienced investors looking to incorporate fractional positions into sophisticated strategies.

The platform’s research and analysis tools help active traders identify potential fractional investment opportunities based on volatility patterns, sector trends, and other technical factors. This research-driven approach to fractional investing sets Tastytrade apart from more simplified offerings.

In 2025, Tastytrade has enhanced its fractional capabilities with improved portfolio analytics that provide detailed insights into fractional positions alongside whole-share holdings. The platform also offers competitive pricing for options trading, making it attractive for investors who combine fractional equity investing with options strategies.

Why Choose Tastytrade for Fractional Shares: For active traders who want to incorporate fractional positions into data-driven trading strategies, Tastytrade’s sophisticated platform and probability-based approach offer a unique value proposition.

10. Vanguard: Best for Long-Term ETF Investors

Fractional Offering Highlights:

- Securities Available: Vanguard ETFs only

- Minimum Investment: Varies by fund

- Fractional Purchases: Yes (for Vanguard ETFs only)

- Fractional Dividend Reinvestment: Yes (for stocks, ETFs, and mutual funds)

- Unique Feature: Seamless integration with Vanguard’s low-cost ETF ecosystem

Vanguard offers a more specialized fractional share experience focused primarily on its own ETFs. While investors cannot purchase fractional shares of individual stocks directly, Vanguard allows fractional purchases of its industry-leading ETFs, which themselves provide diversified exposure to thousands of underlying securities.

This focused approach aligns with Vanguard’s emphasis on long-term, low-cost investing. For investors primarily interested in building diversified portfolios through Vanguard’s renowned ETF lineup—which includes some of the market’s largest and most liquid funds—the ability to purchase fractional shares enhances accessibility and enables precise dollar-based investing.

Vanguard’s dividend reinvestment program extends beyond its ETFs to include stocks and mutual funds, allowing for the compounding of dividend income across the portfolio. The broker’s emphasis on investor education and long-term planning provides a strong foundation for fractional ETF investors.

While Vanguard’s trading platform lacks some of the bells and whistles offered by competitors, its focus on low costs and long-term investing philosophy resonates with many fractional investors seeking to build wealth steadily over time.

Why Choose Vanguard for Fractional Shares: For investors whose primary goal is building long-term wealth through Vanguard’s renowned ETF lineup, the broker’s focused fractional offering provides the essential tools without unnecessary complications.

How to Choose the Right Fractional Share Broker for Your Needs

Selecting the ideal broker for fractional share investing depends on your specific financial goals, investment style, and preferences. Here are key factors to consider when making your decision:

1. Available Securities

The breadth of fractional-eligible securities varies significantly among brokers. Consider whether you’re interested in:

- U.S. stocks only: Most brokers offer a good selection

- International stocks: Interactive Brokers stands out

- Specific indexes: Schwab focuses on S&P 500

- ETFs: Fidelity, Vanguard, and others offer different selections

- Alternative assets: Some brokers like Public offer fractional shares of alternative investments

2. Minimum Investment Requirements

While most brokers have low minimums for fractional purchases, they do vary:

- $1 minimums: Fidelity, Interactive Brokers, Robinhood, Public, J.P. Morgan

- $5 minimums: Charles Schwab, Firstrade, SoFi, Tastytrade

- Other minimums: Some brokers have specific requirements for certain securities

3. Order Types and Execution

Consider what types of orders you can place for fractional shares:

- Market orders only: Some brokers like Tastytrade limit fractional trades to market orders

- Limit orders: Some brokers allow limit orders for fractional purchases

- Execution quality: Research how brokers prioritize fractional orders versus whole-share orders

4. Dividend Handling

How a broker manages dividends can impact long-term returns:

- Automatic reinvestment: Most top brokers offer this

- Fractional dividend reinvestment: Ensure the broker allows dividends to be reinvested into fractional shares

- Dividend eligibility: Some brokers have minimum share price requirements for dividend reinvestment

5. Additional Features and Integration

Consider how fractional investing fits within the broader platform:

- Research tools: Quality of research for security selection

- Portfolio analysis: Tools for understanding your fractional positions

- Automated investing: Availability of recurring investments and rebalancing

- Banking integration: Ease of moving money and viewing your complete financial picture

6. Fee Structure

While most brokers offer commission-free trading for stocks and ETFs, other fees may apply:

- Account fees: Some brokers charge maintenance fees

- Fund expenses: If investing in ETFs fractionally, consider expense ratios

- Cash management: Interest rates on uninvested cash

- Margin rates: For investors using leverage alongside fractional positions

7. Educational Resources

Particularly important for newer investors:

- Beginner resources: Guides specific to fractional investing

- Advanced strategies: Resources for optimizing fractional positions

- Community features: Some brokers offer social elements for learning from others

Maximizing Your Fractional Share Investment Strategy

Now that we’ve explored the top brokers for fractional share investing, let’s examine strategies to optimize your approach.

Building a Diversified Portfolio with Minimal Capital

One of the primary advantages of fractional shares is the ability to build a well-diversified portfolio even with limited capital. Consider these approaches:

- The S&P 500 Sampler: Rather than buying an S&P 500 ETF, you could purchase fractional shares of 10-20 representative companies across different sectors, creating a personalized index.

- Thematic Micro-Portfolios: Allocate small amounts to specific themes like renewable energy, artificial intelligence, or healthcare innovation by purchasing fractional shares of 5-10 leaders in each space.

- Dividend Income Starter: Build a dividend portfolio with fractional shares of established dividend aristocrats, reinvesting dividends to compound returns over time.

- Global Micro-Allocation: Use a broker like Interactive Brokers to create a globally diversified portfolio with fractional positions in companies from multiple countries and regions.

Implementing Dollar-Cost Averaging with Precision

Fractional shares enable precise dollar-cost averaging strategies:

- Fixed-Dollar Investments: Set up automatic weekly or monthly investments of specific dollar amounts regardless of share price fluctuations.

- Gradient Investing: Automatically increase your investment amount over time as your income grows, maintaining consistent percentage allocations across holdings.

- Volatility-Based DCA: Increase your investment amount during periods of higher market volatility to potentially capture better average prices.

Tax Optimization Strategies for Fractional Investors

Fractional shares create unique tax planning opportunities:

- Tax-Loss Harvesting: Harvest losses with precision by selling specific dollar amounts rather than whole shares to offset gains.

- Capital Gains Management: Manage your annual capital gains exposure by selling specific dollar amounts rather than being constrained by whole shares.

- Tax-Efficient Portfolio Construction: Place tax-inefficient investments in tax-advantaged accounts while keeping tax-efficient investments in taxable accounts, all using fractional positions to maintain precise allocations.

The Future of Fractional Share Investing

As we look beyond 2025, several trends are likely to shape the evolution of fractional share investing:

- Expanded Asset Classes: Fractional ownership is likely to extend beyond traditional securities to additional asset classes like bonds, commodities, and private equity.

- Enhanced Customization: Expect brokers to offer increasingly sophisticated tools for building and managing personalized “mutual funds” composed of fractional positions.

- AI-Powered Optimization: Artificial intelligence will likely play a greater role in helping investors optimize their fractional portfolios based on goals, risk tolerance, and market conditions.

- International Expansion: Access to global markets through fractional shares is likely to continue expanding, making truly global portfolios accessible to all investors.

- Integration with Banking: The lines between banking and investing will continue to blur, with fractional investing becoming a standard feature of comprehensive financial platforms.

Conclusion: Embracing the Fractional Future

The rise of fractional share investing represents one of the most significant democratizing forces in the history of financial markets. By eliminating the requirement to purchase whole shares, brokers have removed a crucial barrier to entry and created new possibilities for investors at all levels.

As we’ve explored in this comprehensive guide, the landscape of fractional share brokers in 2025 offers diverse options to suit different investment styles, goals, and preferences. From Fidelity’s all-around excellence to Interactive Brokers’ global reach, from Public’s social dimension to Schwab’s blue-chip focus, there’s a fractional investing solution for every type of investor.

The benefits of fractional investing extend far beyond simply making expensive stocks accessible. These innovations enable more precise portfolio construction, facilitate consistent investment strategies regardless of market price movements, and open up new approaches to diversification and risk management.

As you evaluate which fractional share broker best aligns with your needs, consider not just the current offerings but how they fit into your broader financial goals and strategy. The right broker will serve not just as a platform for transactions but as a partner in your long-term financial journey.

Whether you’re taking your first steps into investing with a few dollars or managing a sophisticated portfolio with precise allocation targets, fractional shares have transformed what’s possible. As this technology continues to evolve, the future of investing looks increasingly fractional—and increasingly accessible to all.

FAQ: Top Brokers for Fractional Share Investing in 2025

What exactly are fractional shares?

Fractional shares allow investors to purchase portions of a stock or ETF rather than a whole share. For example, if a stock trades at $1,000, you could invest $100 to own 0.1 shares of that company. This makes high-priced securities accessible to investors with limited capital and enables precise dollar-based investing.

Do fractional shares pay dividends?

Yes, fractional shareholders receive dividends proportional to their ownership. For example, if you own 0.5 shares of a stock that pays a $2 dividend per share, you’ll receive $1 in dividends. Most brokers automatically process these fractional dividends, and many allow them to be reinvested into additional fractional shares.

What are the main benefits of investing in fractional shares?

The primary benefits include lower financial barriers to entry, enhanced portfolio diversification with limited capital, precise asset allocation, easier implementation of dollar-cost averaging strategies, proportional dividend income, and the educational value of gaining experience with premium stocks without significant capital requirements.

Are there any disadvantages to fractional share investing?

While fractional shares have few drawbacks, potential limitations include restrictions on voting rights for corporate decisions, potential issues when transferring fractional positions between brokers, limitations on order types at some brokers, and potentially slower trade executions compared to whole-share orders at certain brokers.

How are fractional shares taxed?

Fractional shares are taxed the same way as whole shares. When you sell fractional shares, you’ll realize capital gains or losses based on your cost basis and selling price. Dividends from fractional shares are also taxed according to standard dividend tax rules. Brokers track cost basis for fractional positions just as they do for whole shares.

Can I transfer fractional shares between brokers?

Transferring fractional shares between brokers can be challenging. While some brokers may transfer fractional positions, many require fractional shares to be liquidated before an account transfer. It’s advisable to check with both the sending and receiving brokers about their specific policies regarding fractional share transfers.

What happens if I want to sell my fractional shares?

Selling fractional shares works similarly to selling whole shares—you can specify either a dollar amount or a specific fraction to sell. Most brokers process these orders during regular market hours, though execution practices may vary. Some brokers may have minimum sale amounts or specific rules for fractional sell orders.

Can I use limit orders with fractional shares?

This varies by broker. Some brokers like Fidelity and Interactive Brokers allow limit orders for fractional shares, while others like Tastytrade limit fractional trading to market orders only. Check your specific broker’s policies regarding order types for fractional positions.

Are fractional shares only for beginners or small investors?

No, fractional shares benefit investors at all levels. While they certainly make investing more accessible for beginners and those with limited capital, even sophisticated investors with substantial portfolios use fractional shares to achieve precise asset allocations, implement dollar-cost averaging strategies, and diversify across a broader range of securities.

Can I buy fractional shares of any stock or ETF?

The availability of fractional shares varies by broker. Some brokers like Fidelity offer fractional shares for thousands of stocks and ETFs, while others like Charles Schwab limit offerings to specific indexes like the S&P 500. Additionally, some brokers have minimum price or market capitalization requirements for fractional eligibility.