In the world of personal finance, establishing a good credit history is essential. It opens doors to various financial opportunities, from getting approved for loans to securing favorable interest rates. However, not everyone is comfortable with traditional credit cards due to annual fees and interest charges. If you’re looking for an alternative, the Zolve Azpire Credit Builder Card review could be a game-changer.

The Zolve Azpire Credit Builder Card Review – A Brief Overview

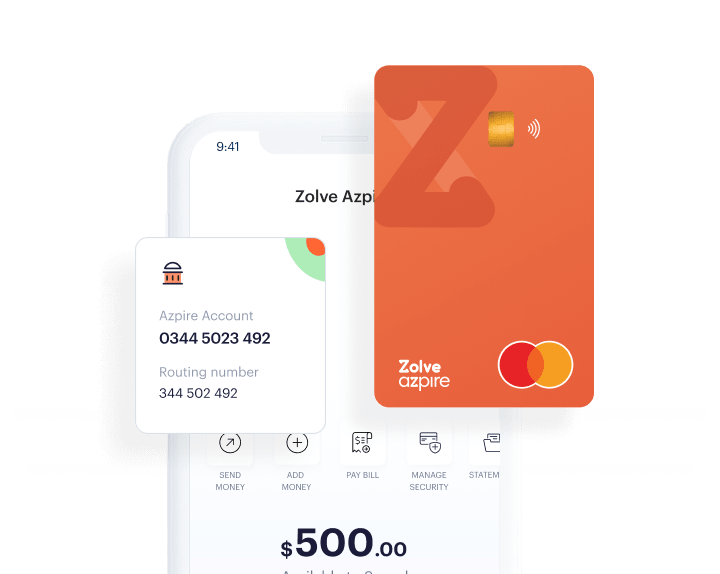

Azpire offers a unique and accessible way to build and rebuild your credit without the hassle of traditional credit cards. Here are some of the key benefits and features of Azpire:

No Annual Fee or Interest

With Azpire, you won’t have to worry about annual fees or interest charges. This means you can focus on building your credit without incurring additional costs.

No Credit Check

Azpire doesn’t require a credit check, making it accessible to individuals with limited or poor credit histories. This can be a valuable opportunity for those looking to establish or repair their credit.

Credit Card Upgrade

Azpire provides a pathway to upgrade to an unsecured credit card with a credit limit of up to $5,000. This upgrade is attainable in as fast as 4 months, helping you transition to a more traditional credit product.

Positive Credit Reporting

All your purchases with Azpire are reported to the credit bureaus as positive repayment behavior. This can help improve your credit score over time, as long as you make timely payments.

Use Your Own Money

Azpire allows you to make purchases online or in stores using the money you have in your account. This eliminates the risk of accumulating debt and overspending.

Easy Credit Building

Azpire makes credit building straightforward. Every purchase you make contributes to building your credit score, providing a clear path to financial improvement.

No Interest Charges & Late Fees

You won’t incur interest charges or late fees with Azpire, further reducing financial stress and making it easier to manage your credit responsibly.

Amazing Rewards

Azpire offers up to 10% cashback on a wide range of outlets, including groceries, restaurants, fashion, shopping, and more. These rewards add extra value to your spending.

Safety and Security

Azpire prioritizes your financial security. Your account is FDIC insured up to $250,000, and the card comes with Mastercard ZERO liability protection. Additionally, advanced encryption ensures the security of your transactions.

Flexibility in Application

You can apply for Azpire with your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or passport, providing flexibility to a wide range of applicants.

Azpire offers a convenient and accessible way to build or rebuild your credit while enjoying the benefits of cashback rewards, no annual fees, and the opportunity to upgrade to a traditional credit card. It’s a valuable tool for those seeking to improve their financial future while maintaining financial discipline.

A Unique Approach to Building Credit

The Zolve Azpire Credit Builder Card is not your typical credit card. It’s a debit card with a unique twist—it helps you build credit. This card stands out because it reports your payment history to all three major credit bureaus, allowing you to establish a positive credit history without the worry of annual fees or interest charges.

Accessibility for All

One significant advantage of the Zolve Azpire card is its accessibility. You don’t need a Social Security number to apply, and there are no credit checks or minimum deposit requirements. This makes it an ideal choice for individuals with bad credit, fair credit, or no credit history.

How It Works

To utilize the Zolve Azpire card, you’ll need to link it to an Azpire checking account. The funds in this account serve as your credit limit. When you make purchases with the Azpire card, the issuer automatically deducts the amount from your account and reports your positive payment history to credit bureaus. Over time, this can help boost your credit score, possibly allowing you to graduate to an unsecured credit card with a $5,000 limit in just four months.

Pros and Cons

Pros of the Zolve Azpire Credit Builder Card

- Credit Reporting: The card reports payment history and account age to all three credit bureaus, helping you establish a positive credit history.

- No Fees or Interest: There are no annual fees or interest charges, making it a safer option than traditional credit cards.

- Upgrade Potential: Responsible card use may lead to an upgrade to an unsecured credit card with a higher limit.

- Accessibility: No Social Security number, credit check, or minimum deposit required, making it accessible to a wide range of individuals.

Cons of the Zolve Azpire Credit Builder Card

- Credit Utilization: The card doesn’t report on credit utilization, a crucial factor in your credit score.

- Limited Cash Back: Cash back rewards are limited to Dosh offers, which may be available without the Azpire card.

- Limited Rewards: The unsecured Zolve card may not offer the most lucrative rewards after you’ve built better credit.

READ ALSO: Discover it Secured Credit Card Review: A Path to Cash Back and Improved Credit

Exploring the Current Card Offer

Rewards Rate

While the Zolve Azpire card doesn’t have a traditional cash back program, it can still earn rewards through its partnership with Dosh, a cash back app. This partnership allows you to earn cash back on various purchases, including hotel bookings, retail shopping, dining, and more.

Earning Cash Back

With the Azpire card, you can earn cash back rates ranging from 1.5 percent to up to 10 percent through Dosh. Linking your Azpire card to Dosh enables you to earn cash back automatically, without needing to add individual offers to your card. While Dosh offers significant cash back potential, keep in mind that it may only be available for specific brands and possibly for a limited time.

Redeeming Rewards

Redeeming cash back earned with the Zolve Azpire card and Dosh is straightforward. Once you’ve accumulated at least $15 in cash back, you can transfer the funds to your Azpire account, PayPal, or Venmo. You also have the option to donate your cash back to charity.

Other Cardholder Perks

Building Credit with a Debit Card

One of the most appealing aspects of the Zolve Azpire card is that it’s a debit card that can build credit. While typical debit card activity doesn’t affect your credit score, the Azpire card’s automatic payback structure changes that. By using the card for purchases and maintaining a sufficient balance in your Azpire account, you can demonstrate your creditworthiness through positive payment history. However, it’s important to note that the card doesn’t report on credit utilization, which could impact your credit-building progress.

No Credit Check Required

As the Zolve Azpire is a debit card, there’s no need for a credit check during the application process. This makes it an excellent choice for those looking to avoid the credit inquiry that typically accompanies credit card applications. Additionally, if you don’t have or prefer not to share your Social Security number, or if you’re an international student or immigrant looking to build U.S. credit history, this card offers a convenient solution.

Upgrade Opportunities

Another significant advantage of the Zolve Azpire card is the potential for an upgrade to an unsecured Zolve Credit Card. If your account remains in good standing, you could transition to an unsecured card in as little as four months. The Zolve Credit Card doesn’t require a security deposit and offers credit limits of up to $5,000, along with cash back rewards.

Rates and Fees

The Zolve Azpire card differentiates itself by avoiding many of the drawbacks associated with traditional credit cards. It has no annual fees, interest charges, or foreign transaction fees. This means you won’t incur high costs while building your credit. However, since it operates as a debit card, it lacks the flexibility of a traditional credit card APR. You won’t have the option to carry a balance, which could be advantageous in certain situations, even if it incurs some interest charges.

The Zolve Azpire Credit Builder Card offers a unique approach to building credit without the common fees and interest charges associated with traditional credit cards. Its accessibility and potential for upgrading to an unsecured credit card make it an attractive option for individuals looking to establish or rebuild their credit. However, it’s essential to consider its limitations, particularly the lack of credit utilization reporting. As with any financial decision, weigh the pros and cons to determine if this card aligns with your credit-building goals.

Zolve Azpire card compared to other credit-building cards

Comparing the Zolve Azpire card to other credit-building cards provides a clearer picture of its strengths and weaknesses. Here’s a breakdown of how it compares to two alternative credit-building cards:

Zolve Azpire Credit Builder Card + Checking Account:

- Annual Fee: $0

- Rewards Rate: 10%

- Credit Reporting: Reports payment history and account age but not credit utilization.

- Flexibility: No credit check, no interest charges, and the ability to build credit with your own funds.

- Upgrade Option: Allows for an upgrade to an unsecured card with cashback rewards and a higher credit limit.

The Zolve Azpire card offers a simple and cost-effective way to build credit without a traditional credit card. It’s suitable for those who want to avoid credit checks, annual fees, and interest charges while gradually improving their credit history.

Capital One Platinum Secured Credit Card:

- Annual Fee: $0

- Rewards Rate: N/A

- Credit Reporting: Reports credit utilization, helping build credit effectively.

- Deposit: Allows for a small refundable security deposit (as low as $49) and provides a starting credit limit of $200.

- Upgrade Option: Potential to upgrade to an unsecured Capital One card with responsible use.

The Capital One Platinum Secured card is a low-risk option for building credit. It reports credit utilization to credit bureaus, which can be advantageous for credit building. It also offers the opportunity to upgrade to an unsecured card.

Discover it® Secured Credit Card:

- Annual Fee: $0

- Rewards Rate: 1% – 2% cashback in various categories.

- Credit Reporting: Reports credit utilization and offers the potential to transition to an unsecured card after seven months of responsible use.

- Deposit: Provides a credit limit of up to $2,500 with a matching deposit.

- Late Fees: Forgives the first late payment fee (subsequent fees may apply).

The Discover it® Secured Credit Card offers cashback rewards in popular spending categories, making it an attractive option for those looking to earn rewards while building credit. It also reports credit utilization and provides a clear path to transitioning to an unsecured card.

To Recap

The Zolve Azpire card is a convenient choice for credit building, especially if you prefer a debit card-like approach without credit checks or interest charges. However, it lacks the ability to report credit utilization, which could impact credit building efficiency. Alternative secured credit cards like the Capital One Platinum Secured card and Discover it® Secured Credit Card offer the advantage of reporting credit utilization and the potential for higher credit limits and rewards, making them attractive options for some individuals. Ultimately, the choice depends on your specific credit-building goals and preferences.

FAQs

Is the Zolve Azpire Credit Builder Card a traditional credit card?

No, it’s a debit card with the unique ability to build credit by reporting payment history to credit bureaus.

How can I earn cash back with the Azpire card?

You can earn cash back through its partnership with Dosh, a cash back app, offering rewards for various purchases.

What is the minimum cash back redemption amount for the Azpire card?

You can redeem cash back once you’ve accumulated at least $15.

Can I upgrade to an unsecured credit card with the Zolve Azpire card?

Yes, if your account remains in good standing, you may be eligible for an upgrade to the unsecured Zolve Credit Card.

Does the Zolve Azpire card charge annual fees or interest?

No, it does not have annual fees or interest charges, making it a cost-effective option for building credit.

In other article, Credit Building for Beginners: A Comprehensive Guide